Money-back policy insurance is a type of life insurance product that combines investment with protection. This unique financial tool offers a blend of life insurance coverage and periodic returns of a portion of the premium paid, which can be used for various financial needs. In essence, money-back policies are designed to provide financial security while also serving as an investment vehicle. This document delves into the intricacies of money-back policy insurance, exploring its features, benefits, and how it compares to other types of insurance producd.

Definition and Structure

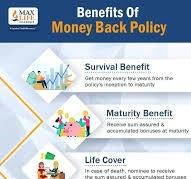

A money-back policy insurance is a life insurance product that guarantees periodic returns of a portion of the premium amount paid by the policyholder. Unlike traditional life insurance policies that only provide a death benefit or maturity benefit, money-back policies offer both. These policies typically have a predetermined tenure, during which the policyholder receives a certain percentage of the sum assured at regular intervals. This interval is known as the “money-back period,” which can vary based on the policy terms

Premiums

The policyholder is required to pay premiums at regular intervals, which could be monthly, quarterly, or annually. In return, they receive periodic payouts during the policy term, usually in the form of a percentage of the sum assured. At the end of the policy term, the remaining sum assured, if any, is paid out as a maturity benefit, provided the policyholder is alive. This combination of periodic payouts and maturity benefits makes money-back policies particularly attractive to individuals seeking both investment growth and insurance coverage.

Features of Money-Back Policies

One of the most distinguishing features of money-back policies is the regular payouts received by the policyholder. These payouts are usually a percentage of the sum assured and occur at fixed intervals, such as every five years or every few years, depending on the policy’s terms. This feature provides a steady source of income, which can be particularly useful for meeting regular financial obligations or achieving specific financial goals.Money-back policies offer life insurance coverage throughout the policy term. In the event of the policyholder’s death during the term, the nominee receives the full sum assured, which includes both the periodic payouts received and the remaining sum assured. This ensures that the policyholder’s family is financially protected, even if the policyholder passes away unexpected

Financial security

M0ney-back policies provide financial security by offering life insurance coverage and regular payouts. This combination ensures that policyholders and their families are financially protected while also receiving periodic returns to meet financial needs.The periodic payouts and maturity benefits offered by money-back policies contribute to investment growth. Policyholders can benefit from the accumulation of bonuses and additional benefits, which can enhance the overall returns on their investment. Money-back policies offer flexibility in terms of premium payment frequency and policy term. Policyholders can choose the payment frequency and term that best suits their financial situation and goals. This flexibility allows individuals to tailor the policy to their specific needs.

Investment component.

Term insurance provides pure life insurance coverage with no investment component. It offers a high sum assured for a lower premium compared to money-back policies. However, term insurance does not provide any payouts during the policy term, and the policyholder only receives a benefit if they pass away during the term. Money-back policies, on the other hand, offer periodic returns and a maturity benefit, making them more suitable for individuals seeking both insurance and investment growth.

combine

Investment

Endowment policies combine life insurance coverage with coonent investment, similar to money-backpolicies. However, endowment policies typically provide a lump sum payout at the end of the policy term, while money-back policies offer regular payouts throughout the term. Endowment policies may also have a higher premium compared to money-back policies due to ULIPs are investment-oriented insurance products that offer a combination of life insurance coverage and investment opportunities. Policyholders can invest in various funds based on their risk appetite and financial goals. While ULIPs offer investment flexibility and potential higher returns, they may also involve higher charges and risks compared to money-back policies. Money-back policies provide more predictable returns and regular payouts, making them a more stable option for some investors

Conclusion

Money-back policy insurance offers a unique blend of life insurance coverage and investment benefits. Its features, including regular payouts, life insurance coverage, and maturity benefits, make it aattractive option for individuals seeking both financial protection and investment growth. By understanding the features, benefits, and comparisons with other insurance products, individuals can make informed decisions about incorporating money-back policies into their financial planning strategies. As with any financial product, it is crucial to evaluate personal needs, goals, and financial situations